The roundup Blog

Explore what it means to build big outside the usual metro echo chambers. The Roundup brings together founder spotlights, thought leadership on rural entrepreneurship and alternative financing, and updates from the GCVF community.

Filter By:

GCVF Standard Terms & Reps for Investment Docs

Recently we realized that, along with most investors, we didn’t have a clear set of standard terms and reps that were easily sharable for founders we work with. By the time we get to final diligence and papering a deal, we like to have addressed the following items, and there is nothing worse than spending several cycles going back and forth on what are fairly common items in our business. That is the last thing either party wants!

Greater Colorado Venture Fund — The Nation’s First Rural Focused VC Fund

From day one, GCVF’s mission has been to generate venture returns outside of metro environments using sustainable, repeatable, and profitable investment models. This will lead to growth, job creation, and opportunity for founders and communities regardless of geographical location.

The spreadsheet our fund uses to model Indie-VC-structure investments with founders

About a year ago, we held the Alternative Capital Summit in Denver, CO. The event birthed helpful direction for the plight of the 81% of founders who are left behind by the debt-equity paradigm.

A Founder’s Guide to Startup Valuations in Colorado

Startup Valuations are an elusive dance where you learn a lot about founders and other investors. More often than not, the valuation conversation is a pretty straight forward one, but in the cases it’s not, it can easily create a lot of anxiety and headaches or even needlessly kill deals.

Exploring Revenue Based Investment? Read this first.

For many companies, capitalizing on an opportunity requires outside capital. However, many startups don’t have the collateral or operating history to secure debt.

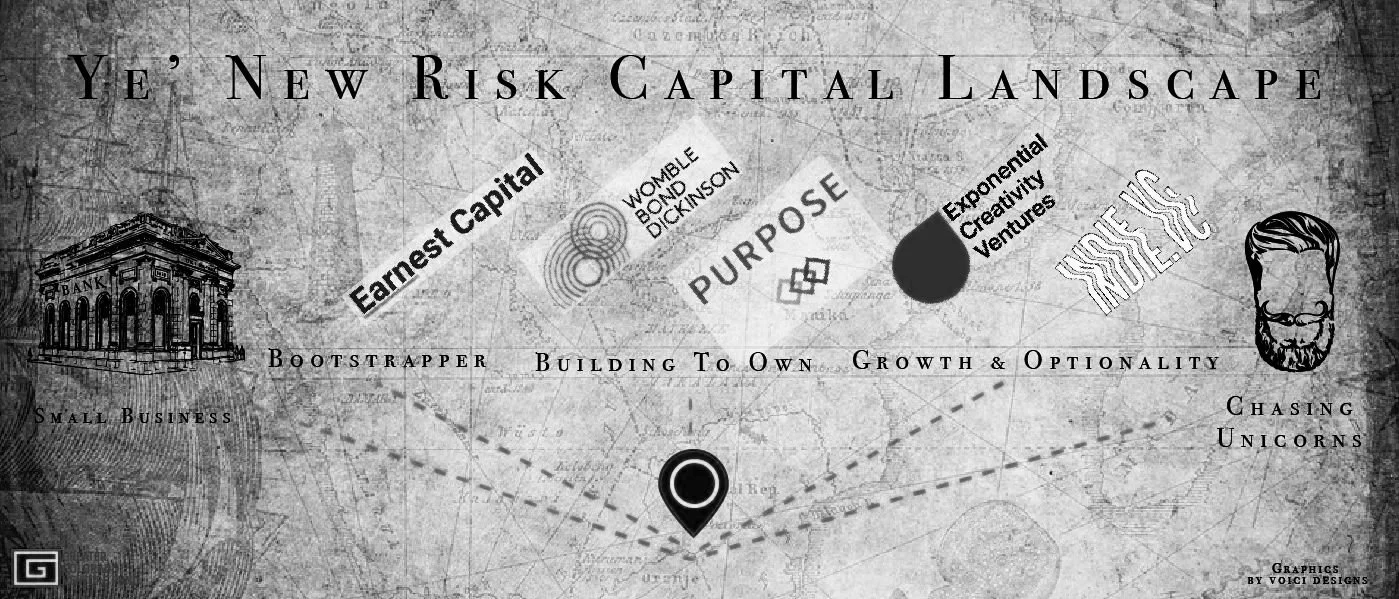

Vocabulary for the New Risk Capital Landscape

In order for new risk capital structures to become common practice, we need to create a common way of discussing them.

A Hitchhiker's Guide to the New Risk Capital Landscape

The old and still predominant risk capital landscape is an equity monopoly.

Sand Hill Road was built on the backs of a subset of a subset of companies who were a fit for venture capital–and then executed brilliantly. These are magnificent success stories that provided magnificent, deserved returns for their investors and employees.

Unfortunately, all current day methodologies, classes, events, frameworks, and vocabulary in the startup world are created to perpetuate this one specific paradigm for funding, growing, and exiting .1% of companies. As a result, countless startups have sold equity to raise funds when it is not a fit for the business they aimed to build.